Legacy Insurance - A Pillar of Wealth

Rethink Life Insurance – benefit from this pillar of wealth strategy that allows you to protect your future and build your legacy while offering tax-free access to cash now. A flexible way to build wealth.

Watch the video below to learn about wealth building through insurance.

Interested in learning more about this wealth building tool?

Sign up for our series of informational videos on Participating Life Insurance and we will share all of the secrets and advantages of this financial strategy.

Why is this type of life insurance such a wealth secret?

Legacy insurance is a type of permanent life insurance that is often overlooked when it comes to building wealth. However, it can be a powerful tool for those looking to grow and protect their assets. Participating life insurance is unique in that it offers not only a death benefit but also the ability to accumulate cash value and earn dividends.

Here are some reasons why participating life insurance is such a wealth secret.

1. Tax-Deferred Growth of Cash Value

One of the most significant advantages of participating life insurance is the ability to accumulate cash value on a tax-deferred basis. This means that the money inside the policy grows without being subject to income tax. This can be particularly beneficial for high-income earners who are looking for tax-efficient ways to grow their wealth.

2. Dividends

Participating life insurance policies can also earn dividends. These dividends are a share of the insurance company’s profits and are not guaranteed, but they can provide a valuable source of additional income. Dividends can be used to pay premiums, purchase additional coverage, or accumulate inside the policy, further increasing its value.

3. Protection of Wealth

Participating life insurance can also help protect wealth from the unexpected. The death benefit can provide financial security for loved ones in the event of the policyholder’s passing. Additionally, the cash value inside the policy can be used to supplement retirement income or pay for unexpected expenses.

4. Flexibility

Participating life insurance policies are flexible and can be tailored to meet individual needs. Policyholders can choose the amount of coverage, the premium payments, and the investment strategy. This allows individuals to create a policy that aligns with their financial goals and risk tolerance.

5. Estate Planning Benefits

Participating life insurance can also be used as a valuable estate planning tool. The death benefit can help cover estate taxes, ensuring that heirs receive the assets they are entitled to. Additionally, the cash value inside the policy can be used to provide liquidity to the estate, allowing assets to be distributed more efficiently.

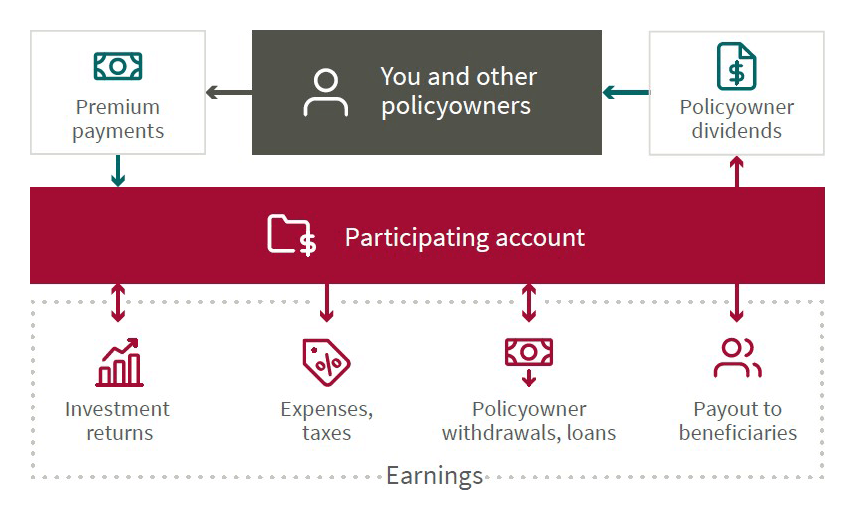

How The Participating Life Insurance Account Works

The participating account is the engine of participating life insurance. The potential dividends you may receive by your policy’s participation in the account are what make it unique and valuable.

A portion of your premium covers the cost of insurance, while the other portion of your money goes into an investment (cash value) that grows on a tax-deferred basis. The cash value can be used throughout your life, and the death benefit will include any accumulated cash value left in the policy. Upon death, your named beneficiaries or a charity of your choosing will receive a tax-free lump sum distribution.

In conclusion, participating life insurance is a wealth secret that is often overlooked. Its ability to accumulate cash value on a tax-deferred basis, earn dividends, protect wealth, offer flexibility, and provide estate planning benefits makes it a valuable tool for those looking to build and protect their assets. By working with an advisor at Aspire Wealth, individuals can design a policy that meets their unique needs and helps them achieve their financial goals.